Why visit ACE ’24?

The business jet market was strong in 2022 according to Global Jet Capital's market report. Flight operations improved year-over-year and manufacturers received a high level of orders. Transactions were down compared to a brisk 2021 but were higher than pre-COVID levels. Aircraft listings increased, although pricing remained stable as overall inventory levels were still low, but the biggest question going forward is the health of the global economy, with many economists expecting a recession in 2023. Due to business aviation’s unique value proposition, the business jet market has remained resilient but GJC feels it will likely be tested this year.

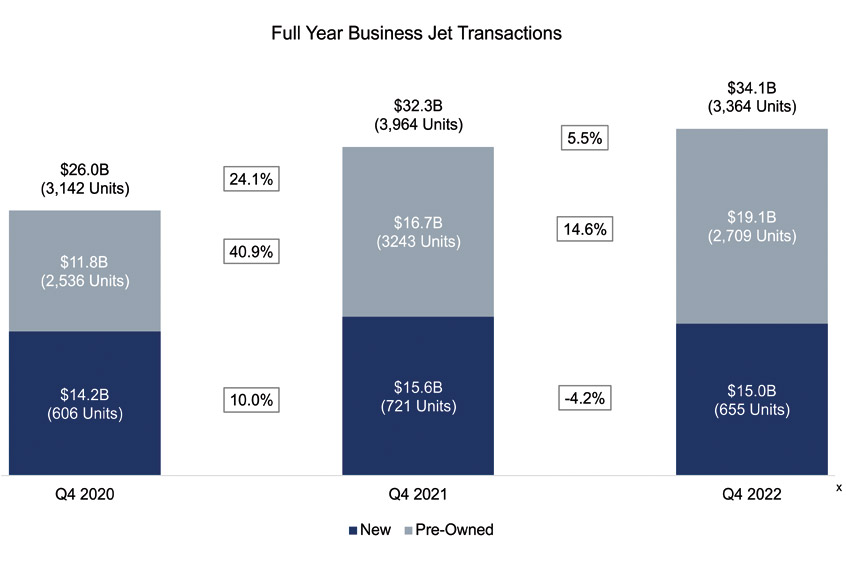

GJC suggests that the economic contraction may be less severe than originally expected, and says that while flight operations dipped slightly in Q4 2022, they remained nearly 18 per cent above 2019 levels, demonstrating that the broadening of the business aviation user base has endured. OEMs experienced robust demand, driving up backlogs, and strong deliveries and normalising order intake during Q4 resulted in lower book-to-bill ratios.

Pre-owned transaction levels were down last year compared to a red-hot 2021 but were higher than pre-COVID levels, and inventory levels increased along with aircraft listings but remained well below historical levels. With demand strong and supply remaining low, business jet bluebook values increased in Q4, but signs that the market is normalising began to emerge.

In relation to the global economy, GJC says that supply chain disruptions and high inflation drove central banks to raise interest rates in 2022, creating uncertainty. The war in Ukraine and the ensuing energy instability in Europe, in addition to zero-COVID policies in China through much of the year, contributed to economic headwinds. As a result, economic growth slowed and stock prices and wealth declined.

Heading into 2023, economists expect economic headwinds to persist, it says. There is a consensus that most major economies will experience a recession during the year due to higher interest rates. However, there is also agreement that any recession that does occur will be a moderate one. The IMF recently increased its 2023 growth forecasts citing slowing inflation, an opening of China’s economy, the strong labor market in the US and the better-than-expected response to the energy crisis in Europe. The report indicates there are still risks to economic growth, which will be slower in 2023 than 2022, but the overall global economy is weathering tough conditions better than expected so far, which will promote higher growth than previously forecast.

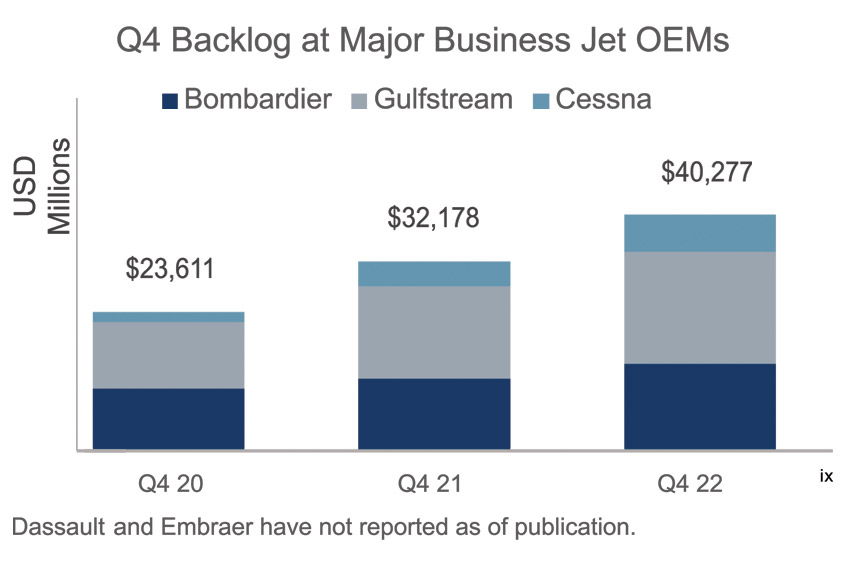

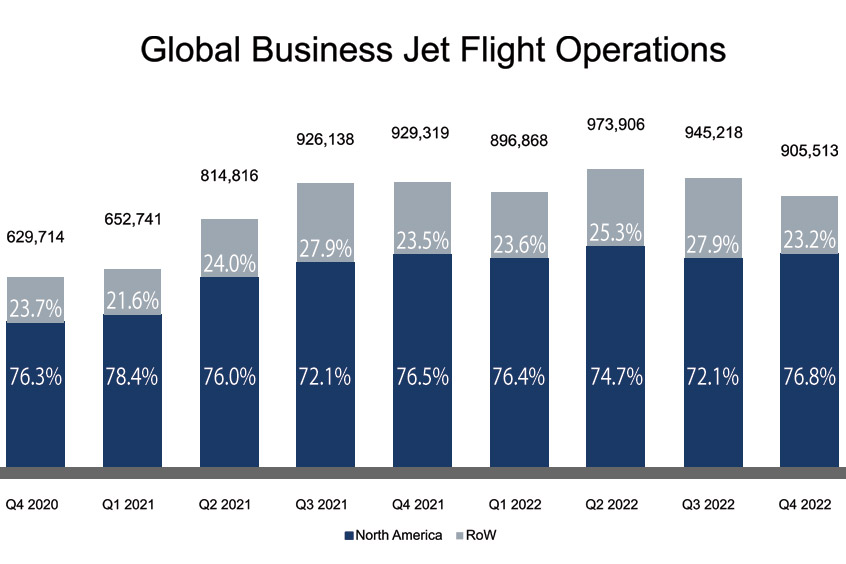

Flight operations were a bright spot for the business aviation market last year. Flights were 12 per cent higher than in 2021 and 19.1 per cent higher than in 2019. Increases were driven by existing customers returning to business aviation even as new customers who had entered the market during COVID continued to utilise business aviation throughout the year. The strong value proposition of business aviation (including flexibility, productivity and comfort) during a period of continued COVID outbreaks and disruptions to commercial travel drove customers to the market.

The number of flights during Q4 declined slightly, dropping 2.6 per cent compared to 4Q21 and 4.2 per cent from 3Q22. The number of flights was 17.8 per cent above 2019 however, demonstrating that the demand for business aviation has continued at a higher plateau than pre-COVID levels. Much of the decline was driven by operations in Europe, as consumers and businesses cut travel in the face of high energy prices. In addition, many business aircraft fleet operators reached full capacity in 2022, capping how many additional flights they were able to make.

Heading into 2023, areas of potential growth for flight operations include increased private and business usage and increasing demand in Asia Pacific and the Middle East.

OEMs had a strong year in 2022, with orders from new users entering the business jet market, habitual pre-owned buyers electing to order new aircraft due to low pre-owned inventory, typical replacement and trade up orders, and fleet operators experiencing increased demand for their services. Despite slowing a bit in 4Q22, growth continued. The industry-wide book-to-bill ratio remained above 1-to-1 in the quarter. While orders were not as strong as in the beginning of 2022, they hovered around historical norms. At the same time, year-end deliveries were high, a normal practice for the industry. The result of normalising orders and high deliveries was a decline in the book-to-bill ratio in the quarter.

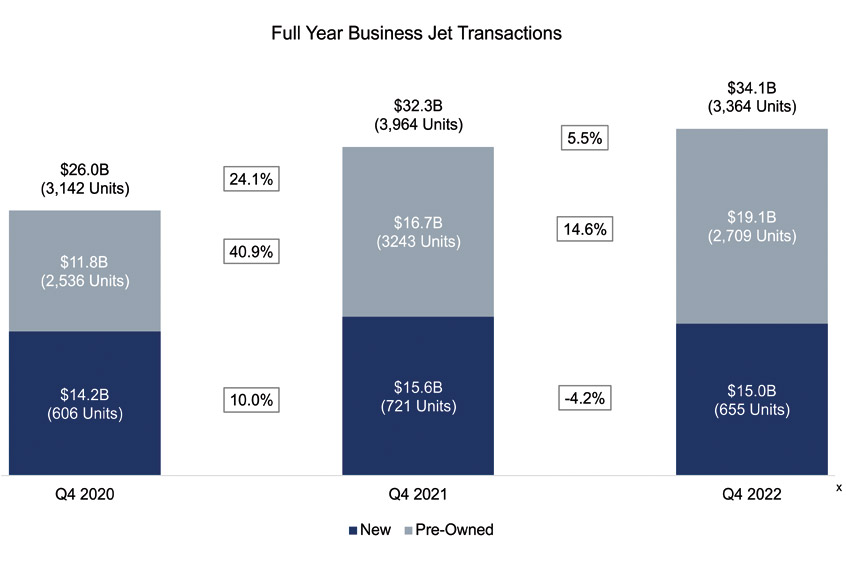

Throughout 2022, buyers acquired new and pre-owned aircraft at a strong pace. The total number of new deliveries and pre-owned transactions declined 15.1 per cent in 2022 compared to 2021. However, 2022 transactions were 7.1 per cent higher than 2020 and 7.5 per cent higher than 2019. The pace of transactions in 2021 was not sustainable, given the substantial decline in pre-owned inventory and continued supply chain disruptions affecting new aircraft production. The strength of the market in 2022 compared to previous years, however, demonstrated the continued demand for business jets among fleet operators and individual users.

Even as unit volume declined in 2022, dollar volume increased 5.5 per cent due to rising aircraft prices. This was largely in the pre-owned market, driven by increases in trading.

After declining throughout 2020 and 2021, total aircraft listings during 2022 were 23.7 per cent higher than 2021. It is important to note, says GJC, that the increase is partly due to comparison with a low level in 2021. Listings in 2022 were 6.3 per cent lower than levels in 2019. Reports from industry observers indicate that some aircraft owners may have been motivated to sell their aircraft to take advantage of the pricing environment. In addition, many aircraft sales in 2021 involved unlisted aircraft, while aircraft sellers in 2022 returned to publicly listing their aircraft for sale. Listings may increase in 2023 when new deliveries begin to pick up, with owners marketing their current aircraft after taking delivery of new aircraft. This was in evidence when listings increased in Q4 2022 as deliveries increased.

As aircraft listings increased, inventory levels also began to gradually build. By the end of 2022, inventory stood at 5 per cent of the total fleet, higher than the 3.1 per cent at the end of 1Q22 but still well below levels over the last decade. The inventory of aircraft younger than 13 years old (typically seen as more desirable) stood at 3.5 per cent of the global fleet, an increase from the 1.8 per cent seen at the end of 1Q22.

Inventory is expected to continue to gradually increase throughout 2023 as the market returns to more normal conditions. Increased OEM production rates along with increased listings are likely to drive up inventory. Considering the brisk Q4 transaction activity in the pre-owned market, higher inventory should provide buyers with more options when purchasing aircraft moving forward.

With high demand and relatively low supply, business jet bluebook values increased in 4Q22. Average bluebook values climbed 29.5 per cent compared to 4Q21. Values varied model-by-model, with some aircraft outperforming others in the market. Older aircraft, in particular, appreciated in value faster than newer aircraft as many buyers chose to acquire older aircraft during the peak of the market, rising 58.1 per cent. These aircraft provided attractive value to buyers even at elevated prices given the relatively low usage and long useful lives of business jets.

Although prices began to increase in 4Q21, overall values were still depressed at that time due to COVID disruptions. Accordingly, the higher prices in 4Q22 must be considered in the context of the lower prices in 2021. Still, the strong market conditions described above drove a significant increase and many aircraft bluebook values exceeded pre-COVID levels at the end of Q4.

There were signs in Q4 that values were beginning to stabilise. The increase in average bluebook values of 29.5 per cent represented a slower increase than the 37.2 per cent experienced in Q3. While listings at the end of Q4 were still high, the rate of increase began to slow during the quarter, and even decline in some cases, as more inventory was added to the market. With more choice, price negotiations between buyers and sellers were also more balanced than in 2021 and much of 2022. It’s worth noting that business jets are depreciating assets and a steady decline in the price of an aircraft over its lifespan is to be expected. The consensus among industry players is that a stable pricing environment will reemerge as demand and supply come into balance.

GJC concludes that flight operations increased from already high levels in 2021, and while transactions declined and inventory rose compared to 2021, both remained at historically healthy levels. Manufacturers ended the year with strong backlogs and aircraft values remained at high levels, demonstrating continued demand.

Looking toward 2023, the overall macroeconomic environment remains the biggest concern, with many economists expecting a recession. While the business jet market has seen a substantial expansion of its user base and has been resilient to economic volatility, this resilience may be tested in 2023.